Proactive, effective communication between lender and borrower can help build a strong relationship that weathers any storm.

Interest Rates Not Only Factor in Choosing Funding Options

Many small business owners rely on interest rates only to determine which funding option offers the best, most affordable terms. But price is not, and should not be your only determining factor.

Analyzing Financing Options for Your Small Business

Industry tips from field experts to analyze financing options for your small business.

A New Financing Option: Restaurant Crowdfunding

Crowdfunding as a form of financing for restaurants is certainly not a new concept. Many restaurants now offer food and beverage as a form of repayment on investment, which, if done correctly, can provide your restaurant with the necessary capital without giving up any equity.

Why Hasn’t Small Business Lending Evolved?

The time of the traditional bank loan has come and gone. Alternative small business lending resources provide business owners with easily accessible capital without drowning them in a mountain of paperwork and making them wait months for a loan decision.

How the Small Business Life Cycle Affects Your Need for and Access to Capital

As your small business grows and matures, your need for—and access to—capital will evolve. Here are some capital considerations as your business moves through the small business life cycle.

Not All Businesses Qualify for a Merchant Cash Advance

While your chances of obtaining a merchant advance are far greater than securing a small business loan, there still is the possibility of rejection. A merchant cash advance isn’t for every business. Here’s some advice you can follow to help make sure your small business qualifies.

Could Your Small Business Survive Without Smartphones?

Have you ever checked your smartphone while with a customer or negotiating with suppliers? If you think your small business couldn’t survive without smartphones, tablets, or mobile apps, it may be time for a reality check

Small Businesses Adding Jobs as Economy Strengthens: Time to Consider a Merchant Capital Advance?

U.S. job growth showed strong, positive signs as 2013 drew to a close, indicating that small business owners are more confident in economic recovery. Is your small business prepared financially for growth in 2014? Will you be able to add jobs along with the rest of the small business service sector?

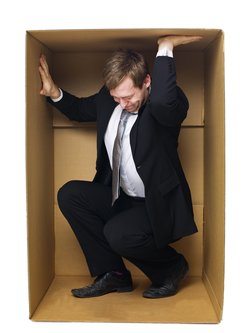

There is No “One Size Fits All” Approach to Small Business Financing

There is no such thing as an “one size fits all” approach to small business finance, although standard loan applications may try to dictate otherwise. What’s your strategy for getting money for your business?